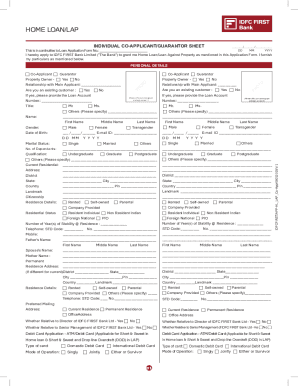

Get Cross-sell Personal Loan Agreement Form - Idfc Bank

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Personal loan agreement online

How to fill out and sign Personal loan format online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Feel all the benefits of completing and submitting legal documents online. With our solution filling in Cross-Sell Personal Loan Agreement Form - IDFC Bank only takes a matter of minutes. We make that achievable through giving you access to our full-fledged editor capable of altering/fixing a document?s initial text, adding unique boxes, and putting your signature on.

Complete Cross-Sell Personal Loan Agreement Form - IDFC Bank in just a few minutes by using the guidelines listed below:

- Select the document template you want from our collection of legal form samples.

- Click the Get form button to open it and start editing.

- Complete all the requested boxes (these are marked in yellow).

- The Signature Wizard will enable you to add your electronic signature right after you have finished imputing info.

- Put the date.

- Double-check the whole document to be certain you?ve filled out everything and no changes are required.

- Hit Done and download the resulting form to your computer.

Send your new Cross-Sell Personal Loan Agreement Form - IDFC Bank in an electronic form right after you finish completing it. Your information is well-protected, because we keep to the most up-to-date security requirements. Become one of numerous satisfied clients who are already submitting legal documents from their apartments.

How to edit Residential address short form: customize forms online

Take full advantage of our comprehensive online document editor while preparing your paperwork. Complete the Residential address short form, indicate the most significant details, and effortlessly make any other essential changes to its content.

Preparing documents electronically is not only time-saving but also gives a possibility to alter the template in accordance with your requirements. If you’re about to work on Residential address short form, consider completing it with our robust online editing tools. Whether you make a typo or enter the requested details into the wrong field, you can instantly make changes to the form without the need to restart it from the beginning as during manual fill-out. Besides that, you can point out the crucial information in your document by highlighting particular pieces of content with colors, underlining them, or circling them.

Adhere to these quick and simple actions to complete and adjust your Residential address short form online:

- Open the form in the editor.

- Type in the required information in the blank fields using Text, Check, and Cross tools.

- Adhere to the document navigation to avoid missing any required fields in the template.

- Circle some of the critical details and add a URL to it if needed.

- Use the Highlight or Line options to point out the most significant facts.

- Decide on colors and thickness for these lines to make your sample look professional.

- Erase or blackout the facts you don’t want to be visible to other people.

- Replace pieces of content containing errors and type in text that you need.

- Finish modifcations with the Done button when you make certain everything is correct in the document.

Our robust online solutions are the most effective way to fill out and customize Residential address short form according to your needs. Use it to prepare personal or professional documents from anywhere. Open it in a browser, make any adjustments to your documents, and return to them at any time in the future - they all will be securely stored in the cloud.

Generally, personal loans cannot be transferred to another person because these loans are determined based on your credit score and list of available sources of income. 1 Some types of personal loans, such as signature loans, require your signature and use your promise to pay as collateral.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.