Loading

Get Ny Dtf St-810 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF ST-810 online

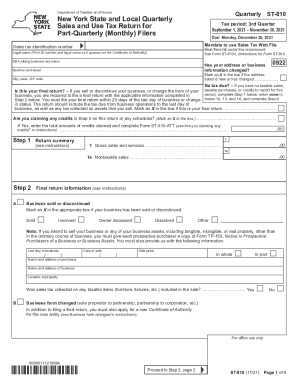

The NY DTF ST-810 is a crucial form for reporting sales and use tax for businesses in New York. This guide provides a detailed, step-by-step approach to completing the form online, ensuring that users can navigate the process with confidence and ease.

Follow the steps to complete the ST-810 form accurately.

- Press the ‘Get Form’ button to access the form and open it in your chosen online platform.

- Provide your legal name as it appears on the Certificate of Authority, followed by your DBA (doing business as) name if applicable.

- If applicable, denote whether you have no taxable sales for this period or if this is your final return by marking the corresponding boxes.

- Proceed to the return summary section by completing Step 1, which involves entering gross sales and services, as well as any nontaxable sales. Make sure to refer to the corresponding instructions if needed.

- Complete any necessary information for claiming credits in Step 3, ensuring you reference Form ST-810-ATT if you claim any credits.

- Calculate the total sales and use tax for each jurisdiction, recording the amounts in the designated columns.

- Finally, enter your total amount due in the final sections, taking note of any penalties or interest for late payments.

- Sign and date the bottom of the form to certify its accuracy. Save your completed form, and consider downloading or printing a copy for your records.

Take action now and complete your NY DTF ST-810 form online to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Sales of services are generally exempt from New York sales tax unless they are specifically taxable.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.