Loading

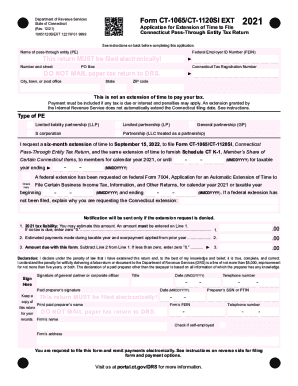

Get Ct Drs Ct-1065/ct-1120si Ext 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS CT-1065/CT-1120SI EXT online

Filling out the CT DRS CT-1065/CT-1120SI EXT is essential for pass-through entities seeking an extension of time to file their Connecticut tax returns. This comprehensive guide will assist you in navigating the form online with ease and accuracy.

Follow the steps to complete your extension request effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the pass-through entity (PE) in the designated field.

- Provide the Federal Employer Identification Number (FEIN) for the entity.

- Fill in the address details, including number and street, PO Box (if applicable), city, town or post office, state, and ZIP code.

- Indicate your Connecticut Tax Registration Number in the corresponding field.

- Select the type of pass-through entity from the options provided: Limited liability partnership (LLP), Limited partnership (LP), General partnership (GP), S corporation, or Partnership (LLC treated as a partnership).

- Request a six-month extension to file the Form CT-1065/CT-1120SI by entering the date to which the extension is requested.

- If a federal extension has been requested, check the appropriate box; if not, provide a brief explanation for the request.

- Estimate and input the 2021 tax liability on Line 1; if no tax is due, enter zero (0).

- Enter the estimated payments made during the taxable year and any overpayment applied from the prior year on Line 2.

- Calculate the amount due with the form by subtracting Line 2 from Line 1 on Line 3; if the result is less than zero, enter zero (0).

- Complete the declaration by providing the name and title of the signer, along with the date and phone number.

- If applicable, have the paid preparer provide their signature, date, and either Social Security Number (SSN) or Preparer Tax Identification Number (PTIN).

- Review all entered information for accuracy before saving changes, downloading, and printing the form for your records.

Begin filling out your CT DRS CT-1065/CT-1120SI EXT online now to ensure timely submission.

Use Form CT-1065/CT-1120SI EXT, Application for Extension of Time to File Connecticut Pass-Through Entity Tax Return, to request a six-month extension of time to file Form CT-1065/CT-1120SI, Connecticut Pass-Through Entity Tax Return, and the same six-month extension of time to furnish Schedule CT K-1, Member's Share ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.