Loading

Get Ca Ftb 589 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 589 online

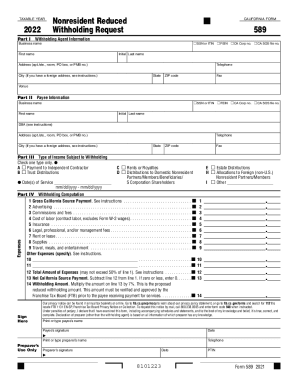

Filling out the California Form 589 online can be a straightforward process with the right guidance. This guide is designed to support users with various levels of experience in completing the Nonresident Reduced Withholding Request form efficiently and accurately.

Follow the steps to complete the CA FTB 589 online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Enter the withholding agent information, including the business name, first name, initial, last name, address, telephone number, city, state, ZIP code, and fax number. Be sure to select the appropriate identification type, such as SSN, ITIN, FEIN, CA Corp no., or CA SOS file no.

- In Part II, provide the payee information using the same fields. Ensure all details are correct to avoid any processing issues.

- Move to Part III, where you will select one type of income subject to withholding. Choose from options like payment to independent contractor, trust distributions, rents or royalties, and more. Fill in the required date(s) of service.

- Now, proceed to the withholding computation section. Begin by entering the gross California source payment and any applicable expenses. Follow the instructions to ensure you include all required details.

- Calculate the total amount of expenses and subtract this from the gross payment to find the net California source payment.

- Finally, compute the withholding amount by multiplying the net California source payment by 7%. This proposed amount requires verification and approval by the Franchise Tax Board before processing.

- Once all sections are complete, ensure you sign and date the form. Double-check all the provided information for accuracy before saving your changes, downloading, printing, or sharing the form as needed.

Start filling out your CA FTB 589 online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A corporation that incorporates or qualifies to do business in California is exempt from paying the minimum franchise tax in its first taxable year. Business entities such as LLCs, LLPs, and LPs are subject to an $800 annual tax.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.