Loading

Get Al Ador Bpt-v 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL ADoR BPT-V online

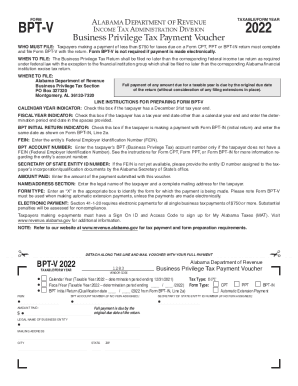

The AL ADoR BPT-V form is essential for taxpayers making a payment of less than $750 due on a Business Privilege Tax return. This guide will provide clear and supportive instructions to help users fill out the form accurately online.

Follow the steps to fill out the AL ADoR BPT-V form online.

- Click 'Get Form' button to access the BPT-V form and open it in an online editor.

- Identify the calendar year indicator. Check this box if your tax year ends on December 31st.

- If your fiscal year ends on a date other than December 31st, check the fiscal year indicator box and enter the end date in the specified spaces.

- If you are submitting a payment with Form BPT-IN (initial return), check the BPT initial return indicator and enter the corresponding date from Form BPT-IN, Line 2a.

- Enter your Federal Employer Identification Number (FEIN). If you do not have a FEIN, proceed to the next instruction.

- If no FEIN is available, enter your BPT account number. Ensure it is correctly entered based on further instructions in related tax forms.

- In the case where neither FEIN nor BPT account number is assigned, provide the Secretary of State entity ID number from your incorporation documents.

- Enter the amount you are paying with this voucher in the 'Amount Paid' section.

- Fill out the name/address section with the legal name of your business and complete mailing address.

- Indicate the type of form you are paying for by marking an 'X' in the appropriate box, noting that Form BPT-V is needed for automatic extension payments unless electronically submitted.

- Ensure you understand that electronic payments are mandatory for single business tax payments of $750 or more, and substantial penalties may apply for failure to comply.

- Once all fields are completed, review to confirm accuracy, then save changes, download, print, or share the completed form as required.

Complete your AL ADoR BPT-V form online today for a smooth filing experience.

Business Privilege Tax (BPT) is filed annually, plus the initial return (BPT- IN) which is due 2½ months after being organized, incorporated, qualified, or registered with the Alabama Secretary of State. The tax is based on the net worth of the company, not the income. The minimum tax due is $100.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.