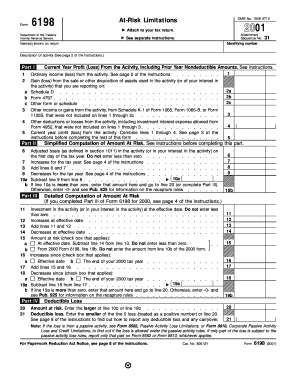

Get Irs 6198 2001

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Computation online

How to fill out and sign Subtract online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Feel all the benefits of completing and submitting legal documents online. Using our platform filling in IRS 6198 only takes a matter of minutes. We make that achievable by giving you access to our full-fledged editor capable of changing/fixing a document?s initial textual content, adding special fields, and putting your signature on.

Execute IRS 6198 in several moments following the guidelines listed below:

- Select the template you need from the library of legal form samples.

- Click the Get form button to open it and start editing.

- Submit the necessary boxes (they will be marked in yellow).

- The Signature Wizard will help you add your electronic autograph after you have finished imputing details.

- Add the relevant date.

- Look through the whole document to make certain you?ve completed all the information and no corrections are needed.

- Click Done and download the ecompleted form to the computer.

Send the new IRS 6198 in a digital form when you finish filling it out. Your data is securely protected, because we keep to the latest security requirements. Join numerous satisfied customers who are already filling in legal templates straight from their apartments.

How to edit Deductions: customize forms online

Say goodbye to an old-fashioned paper-based way of completing Deductions. Get the form completed and certified in minutes with our professional online editor.

Are you challenged to modify and fill out Deductions? With a professional editor like ours, you can complete this task in mere minutes without having to print and scan paperwork back and forth. We provide you with completely editable and straightforward form templates that will serve as a starting point and help you fill out the required document template online.

All forms, automatically, contain fillable fields you can complete once you open the template. However, if you need to polish the existing content of the form or add a new one, you can choose from a number of editing and annotation tools. Highlight, blackout, and comment on the document; add checkmarks, lines, text boxes, graphics and notes, and comments. Moreover, you can swiftly certify the template with a legally-binding signature. The completed form can be shared with other people, stored, sent to external apps, or converted into any popular format.

You’ll never make a wrong decision using our web-based tool to complete Deductions because it's:

- Straightforward to set up and utilize, even for those who haven’t completed the documents online before.

- Powerful enough to accommodate various editing needs and form types.

- Safe and secure, making your editing experience safeguarded every time.

- Available across different devices, making it effortless to complete the form from anyplace.

- Capable of creating forms based on ready-made templates.

- Compatible with numerous file formats: PDF, DOC, DOCX, PPT and JPEG etc.

Don't waste time editing your Deductions the old-fashioned way - with pen and paper. Use our feature-rich tool instead. It offers you a comprehensive set of editing tools, built-in eSignature capabilities, and ease of use. What makes it differ from similar alternatives is the team collaboration capabilities - you can work together on documents with anyone, create a well-structured document approval workflow from A to Z, and a lot more. Try our online solution and get the best value for your money!

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to IRS 6198

- 50012Y

- 1120s

- nondeductible

- carryover

- K-1

- OMB

- 1065-B

- III

- Computation

- DECREASES

- simplified

- subtract

- Deductions

- recapture

- completing

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.