Loading

Get Vt Dmv Vt-010 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VT DMV VT-010 online

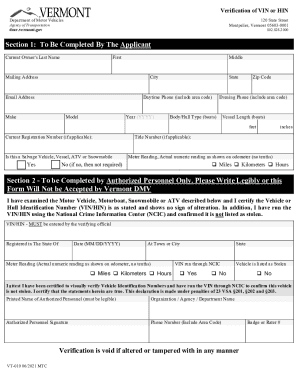

This guide provides clear and supportive instructions for completing the VT DMV VT-010 form online. Follow these steps to ensure accurate and efficient submission of your vehicle or hull identification number verification.

Follow the steps to fill out the VT DMV VT-010 form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Start with Section 1, where you will need to fill out your personal details. Enter the current owner's last name, first name, and middle name, followed by your mailing address including city, state, and zip code.

- Include your daytime phone number with area code, evening phone number with area code, and email address to ensure you can be contacted.

- Provide details about the vehicle or vessel, such as the make, model, year, and body or hull type. If you are filling out this form for a boat, indicate the vessel length in feet and inches.

- If applicable, enter the current registration number, title number, or indicate if the vehicle is a salvage vehicle, vessel, ATV, or snowmobile by selecting 'Yes' or 'No'.

- Fill in the meter reading as shown on the odometer, ensuring you do not include tenths. Select the unit of measurement: miles, kilometers, or hours.

- Section 2 must be completed by an authorized personnel. They will certify the VIN/HIN and confirm the vehicle is not stolen. Make sure they fill in the necessary details legibly.

- The authorized personnel must provide their printed name, organization or agency name, signature, and phone number. Ensure all details are filled out correctly.

- Once all sections are completed, review the form for any errors. You can then save the changes, download, print, or share the form as needed.

Complete your VT DMV VT-010 form online today for a smooth verification process.

Vermont has a 6.00 percent state sales tax rate, a max local sales tax rate of 1.00 percent, and an average combined state and local sales tax rate of 6.30 percent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.