Loading

Get Ok Oes-3b 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK OES-3B online

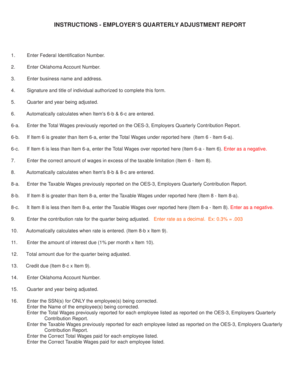

The OK OES-3B form is a vital document for businesses to report adjustments to previously submitted wages and taxable wages. This guide will provide clear, step-by-step instructions on how to complete the form online, ensuring accuracy and compliance.

Follow the steps to accurately fill out the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your federal identification number in the designated field. This number is essential for proper identification of your business.

- Input your Oklahoma account number to connect the form to your business's account.

- Fill in your business name and address as they are registered.

- Sign and provide the title of the individual authorized to complete this form.

- Specify the quarter and year for which you are making adjustments.

- Complete item 6 by entering the total wages previously reported on the OES-3, Employers Quarterly Contribution Report.

- If item 6 is more than the previously reported total wages (item 6-a), enter the amount of wages under reported in item 6-b.

- If item 6 is less than item 6-a, indicate the amount of wages over reported in item 6-c, entering this as a negative value.

- Enter the correct amount of wages in excess of the taxable limitation in item 7.

- Fill out item 8 with the correct taxable wages paid this quarter.

- Complete item 8-a with the taxable wages previously reported.

- If item 8 is larger than item 8-a, report the taxable wages under reported in item 8-b.

- If item 8 is less than item 8-a, specify the taxable wages over reported in item 8-c, entering this as a negative.

- Indicate the contribution rate for the quarter in item 9 as a decimal (e.g., 0.3% = .003).

- Item 10 will automatically calculate the contribution due based on item 8-b and item 9.

- Enter the amount of interest due in item 11 based on formula (1% per month x item 10).

- Calculate the total amount due for the quarter in item 12.

- Enter any credit due in item 13 from item 8-c multiplied by item 9.

- Repeat entering your Oklahoma account number in item 14.

- Reiterate the quarter and year being adjusted in item 15.

- For those employees whose wages are being corrected, enter their Social Security Number, name, previously reported total wages, and taxable wages.

- Finally, verify the correct total and taxable wages paid for each employee listed.

- Once all fields are filled out accurately, save changes, download, print, or share the completed form.

Complete your OK OES-3B form online for accurate reporting today.

Related links form

SUTA tax rate and wage base 2023 Wage BaseMax (%)North Dakota$40,8009.97Ohio$9,0009.7Oklahoma$25,7009.2Oregon$50,9005.447 more rows • 7 Feb 2023

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.