Loading

Get La R-10606 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA R-10606 online

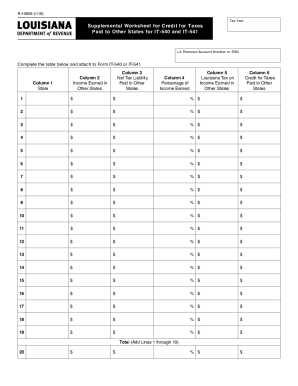

This guide provides clear and supportive instructions for users seeking to complete the LA R-10606 form online, facilitating the process of claiming credit for taxes paid to other states. Whether you are familiar with tax forms or a novice, this guide aims to simplify the experience.

Follow the steps to successfully complete the LA R-10606 form online

- Click ‘Get Form’ button to access the LA R-10606 online form, which you can fill out in an editable format.

- In the first field, enter the tax year for which you are filing this form.

- Next, input your Louisiana revenue account number or Social Security number in the designated area.

- Proceed to complete the table provided by listing the states where income was earned. In Column 1, specify the name of each state.

- In Column 2, indicate the income earned in each of those states.

- Column 3 requires the net tax liability you reported on your other state's tax return. Enter that amount in the corresponding field.

- For Column 4, calculate the percentage of the income earned in that state relative to your Louisiana adjusted gross income. Provide that percentage.

- In Column 5, compute the Louisiana tax on the income earned in other states by multiplying Column 4 by your total Louisiana income tax.

- Column 6 asks for the credit for taxes paid to other states. Input the lesser amount from either Column 3 or Column 5.

- Finally, sum the values from Columns 6 for lines 1 through 19 and enter that total in Line 20.

- Once all fields are completed, save your form. You may then download, print, or share the LA R-10606 form as necessary.

Complete your documents online to ensure a smooth tax filing process.

To verify your tax liability for individual income tax, call LDR at (225) 219-0102. To verify your tax liability for business taxes, you can review your liabilities online using the Louisiana Taxpayer Access Point (LaTAP) system.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.