Loading

Get Mi Lcc-3890 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI LCC-3890 online

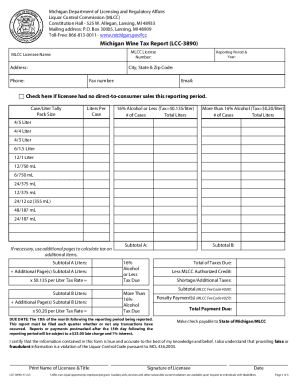

The MI LCC-3890 form is essential for Michigan wineries, wholesalers, and direct shippers to report wine taxes accurately. This guide will provide a step-by-step approach to complete this form online, ensuring all users can navigate it with ease.

Follow the steps to complete the MI LCC-3890 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your business name, license number, address, and contact information in the appropriate fields.

- Indicate the reporting period by selecting the year for which the report is being filed.

- Locate the appropriate pack size and enter the total cases sold in the column under the correct percentage of alcoholic content by volume.

- Use the blank boxes for any pack sizes and liters or cases that are not preprinted on the form. Input liters per case and the number of cases sold in the designated columns.

- Calculate the tax owed by entering the total liters under the applicable tax rates: $0.135 per liter for wine with 16% alcohol by volume or less, and $0.20 per liter for wine with more than 16% alcohol by volume.

- If applicable, enter the amount of any MLCC authorized credits to be subtracted where indicated. Ensure MLCC approval for credits before claiming them.

- Include any penalties owed in the respective section of the form.

- Sign and date the form at the bottom of the first page.

- Pay the total tax due as calculated. Make checks payable to State of Michigan/MLCC.

Complete your MI LCC-3890 form online today to ensure compliance and timely submission.

ing to Deloney, when the state buys a bottle of spirits from a vendor, it adds three taxes of 4% each and those dollars go into a variety of funds within the state government. Then, on top of those three taxes, the price is marked up by 65%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.