Loading

Get Nc Dor D-400 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC DoR D-400 online

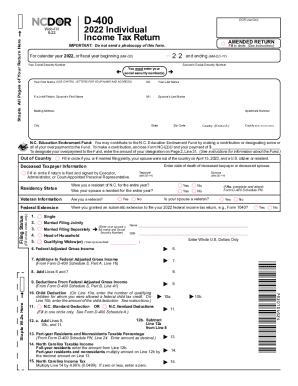

Filling out the NC DoR D-400 form online is a straightforward process. This guide provides step-by-step instructions to help you accurately complete your 2022 individual income tax return with confidence.

Follow the steps to successfully complete your NC DoR D-400 form.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering your Social Security Number, making sure to include your spouse’s Social Security Number if applicable. This information is essential for identification.

- Provide your full name in capital letters, including the first name, middle initial, and last name. If you are filing jointly, include your spouse's information as well.

- Fill in your mailing address completely, including apartment number, city, state, zip code, and county. If you are outside the U.S., entering your country is also required.

- Indicate whether you or your spouse were out of the country on April 15, 2023, and provide the date of death if applicable. If you are filing as an executor or administrator, mark the correct field.

- Select your filing status by circling the appropriate option: single, married filing jointly, married filing separately, head of household, or qualifying widow(er). Ensure that only one circle is filled.

- Report your federal adjusted gross income and any additions or deductions as required in the subsequent fields. Calculate and fill in the totals accurately.

- Complete the child deduction section by noting the number of qualifying children and the total deduction amount.

- Enter the taxable income, either as a full-time resident or as a part-year resident, ensuring all calculations are correct.

- Complete the tax credit sections, including any taxes withheld, other tax payments, and additional payments if you are amending your return.

- After finalizing the amounts due or overpayment, review your entries for accuracy.

- Conclude by signing the form and dating it. Make sure to save any changes, and if applicable, download, print, or share the form as needed.

Complete your NC DoR D-400 form online and ensure your tax submission is accurate and timely.

D-40 Booklet. Individual Income Tax Forms and Instructions for Single and Joint Filers with No Dependents and All Other Filers. On or before April 18, 2022.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.