Loading

Get Ma Dor Abt 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA DoR ABT online

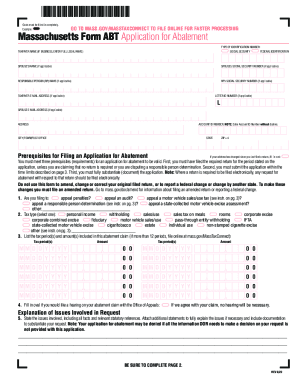

Filling out the Massachusetts Department of Revenue Form ABT, Application for Abatement, can be straightforward if approached step by step. This guide provides detailed instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to complete the MA DoR ABT easily

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Enter your taxpayer name. If you are submitting this for a business, ensure to provide the full legal name.

- Select the type of identification number. Choose either 'Social Security' or 'Federal Identification' as applicable.

- If applicable, provide your spouse’s name and spouse’s Social Security number.

- Enter the name of the responsible person (if applicable) along with their Social Security number.

- Fill in your taxpayer email address and your spouse's email address if applicable.

- Provide your full address, including state, city/town, and ZIP code. Ensure that you enter the Account ID number accurately without dashes.

- Indicate whether your address has changed since your last filed return by filling in the appropriate oval.

- Identify the reason for filing the application by selecting from the provided list, ensuring to detail any additional reasons if necessary.

- Select the specific tax type that your application pertains to from the available options.

- List the tax periods and corresponding amounts included in your abatement claim. You may file online if you have more than 12 periods.

- If you wish to have a hearing on your abatement claim, fill in the appropriate oval.

- Explain the issues involved in your request clearly. Attach any necessary documentation to substantiate your claim.

- Complete the consent section by signing where indicated and including contact information for any attorney-in-fact if applicable.

- After reviewing your completed application thoroughly, save your changes, download, print, or share the form as needed.

Complete your MA DoR ABT application online today for a smoother and faster processing experience.

Taxpayers seeking to obtain an abatement of a tax or penalty that has been assessed by DOR should use MassTaxConnect (MTC) and follow the instructions provided for disputing a tax or penalty. Alternatively, taxpayers may file a paper Form ABT, Application for Abatement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.