Loading

Get Ok Form 561-nr 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK Form 561-NR online

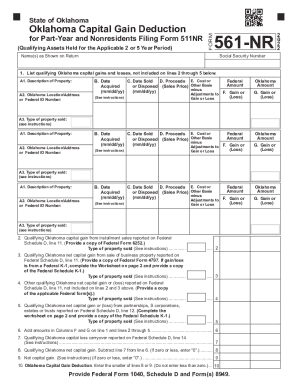

This guide provides a clear and supportive approach to filling out the OK Form 561-NR online. The form is essential for individuals seeking to claim the Oklahoma capital gain deduction for part-year and nonresidents. Follow the steps below to ensure accurate completion of the form.

Follow the steps to fill out the OK Form 561-NR online

- Click ‘Get Form’ button to obtain the OK Form 561-NR and open it for online editing.

- Begin by entering your Social Security number in the designated field. Ensure this information matches your federal tax documents.

- Provide your name(s) as they appear on the return in the corresponding section.

- Section 1 requires you to list qualifying Oklahoma capital gains and losses that are not included in subsequent lines. Fill in the description of property, Oklahoma location or Federal ID number, acquisition date, sale date, proceeds, cost or other basis.

- In fields B through E, enter details regarding the dates and amounts associated with the sale. Ensure that you accurately reflect the financial specifics from your federal tax forms.

- Continue documenting the type of property sold for each entry in Section 1. Select from the types provided and be sure to check the instructions for clarification.

- Move to lines 2 through 5 to report qualifying gains from installment sales, net capital gain from the sale of business property, and others, using appropriate federal forms as documentation.

- For each listed gain, indicate the appropriate adjustments to gain or loss as instructed, always referencing your federal tax reporting.

- Calculate the total amounts in columns F and G and proceed to line 6, where you will sum these amounts to determine your qualifying report.

- Complete the final lines, ensuring any qualifying capital losses are factored in. Determine your Oklahoma capital gain deduction by comparing the relevant lines and entering the smaller amount in line 10.

- After ensuring all information is accurate, you can save your changes, download the completed form, or share it as needed.

Start filling out your OK Form 561-NR online today to ensure you secure your deductions accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.