Loading

Get Ny Dtf It-251 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-251 online

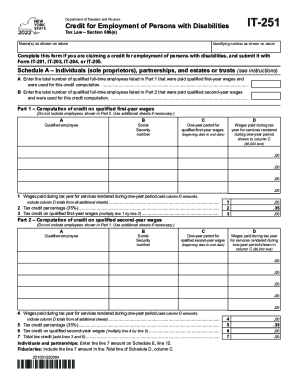

The NY DTF IT-251 form is essential for individuals and entities claiming a credit for the employment of persons with disabilities. This guide will help you navigate the online filling process, ensuring you complete each section accurately and efficiently.

Follow the steps to complete the NY DTF IT-251 online.

- Click the ‘Get Form’ button to access the online version of the NY DTF IT-251 form and launch it in your document editor.

- Provide your name as it appears on your tax return in the designated section at the top of the form.

- Enter your identifying number as shown on your tax return, ensuring it is accurate. This helps link your credential to your tax information.

- Complete Schedule A, starting with the total number of qualified full-time employees from Part 1. Make sure you include only those employees paid qualified first-year wages.

- Calculate the tax credit on qualified first-year wages by following the instructions provided on the form, ensuring all computations are correctly done.

- Next, move on to Part 2, where you will repeat the process for qualified second-year wages, ensuring not to duplicate any employees listed in Part 1.

- Once all computations are complete, sum the tax credits from both parts to determine your total tax credit, which needs to be reported on relevant schedules according to your filing status.

- Complete the Schedule B and C sections if applicable, providing information about partnerships, S corporations, or estates where you might have a share of the credit.

- Finally, review all entries for accuracy, then you can save changes, download, print, or share the completed form accordingly.

Complete your NY DTF IT-251 form online today to ensure you claim your eligible credits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.