Loading

Get Canada T776 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T776 online

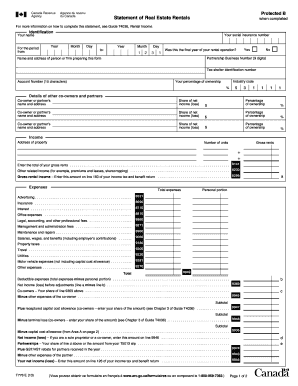

The Canada T776 is a crucial form for individuals reporting rental income and expenses related to real estate operations. This guide provides detailed, step-by-step instructions to help users successfully fill out the form online, ensuring they meet all requirements laid out by tax regulations.

Follow the steps to complete the Canada T776 online effectively.

- Press the ‘Get Form’ button to access the necessary form and open it in your preferred editor.

- Enter your social insurance number (SIN) in the designated field, ensuring accuracy as this will identify your record.

- Fill in your name as it appears on official documents.

- Indicate the year for which you are reporting rental operations.

- Specify the rental operation period by entering the start date and end date using the provided date fields.

- Answer the question regarding whether this was the final year of your rental operation by selecting 'Yes' or 'No'.

- If applicable, enter your partnership business number, the name and address of the person or firm preparing this form, tax shelter identification number, industry code, and your percentage of ownership.

- List details of any co-owners or partners, including their names, addresses, share of net income (loss), and their percentage of ownership.

- In the Income section, provide the address of the rental property, the number of rental units, and total gross rents received.

- Enter any additional related income from sources such as premiums and leases.

- Calculate your gross rental income and ensure it is correctly noted.

- In the Expenses section, enter all applicable costs including advertising, interest, office expenses, legal and professional fees, management fees, maintenance, salaries, property taxes, travel, utilities, motor vehicle expenses, and any other expenses.

- Determine the personal portion of your expenses, if applicable, and subtract it from the total expenses to find deductible expenses.

- Calculate your net income (loss) before adjustments by subtracting deductible expenses from total income.

- If you're a sole proprietor or co-owner, ensure the final net income (loss) is entered correctly, as this will affect your main income tax and benefit return.

- In Area A, detail the calculation of capital cost allowance (CCA) claims, including class numbers, undepreciated capital costs (UCC), additions, and dispositions.

- Provide details for all equipment and property additions and dispositions across the specified areas (B, C, D, E, and F), separating personal portions and rental portions.

- After thoroughly reviewing all inputs for accuracy, save your changes, and prepare to download, print, or share your completed form as necessary.

Complete your Canada T776 form online today for a smooth rental income reporting experience!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

For reporting rental income in Canada, you need to fill out the T776 form. This form allows you to detail your rental income, expenses, and other pertinent information about your property. Utilizing resources like US Legal Forms can simplify the process, ensuring you have accurate and compliant documentation for your taxes.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.