Loading

Get Uk Vat65a 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK VAT65A online

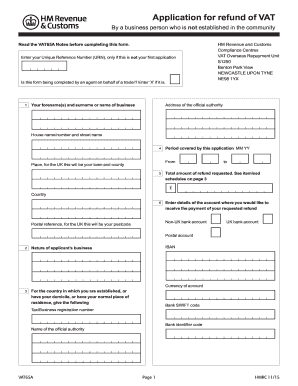

The UK VAT65A form is essential for businesses not established in the community to claim a refund of VAT. This guide provides step-by-step instructions to help users complete the form accurately and efficiently, ensuring they can navigate the online process with confidence.

Follow the steps to fill out the UK VAT65A online successfully.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your Unique Reference Number (URN) if this is not your first application.

- Indicate whether the form is being completed by an agent on behalf of a trader by entering ‘X’ if applicable.

- Provide your forename(s) and surname or the name of your business in the designated field.

- Fill in the address of the official authority, ensuring to include the house name/number and street name.

- Enter the period covered by this application using the MM YY format, specifying the start and end dates.

- State the total amount of refund you are requesting, referring to the itemized schedules for details.

- Specify the details of the bank account where you would like the refund payment directed, selecting between a UK or non-UK bank account.

- Include your bank's details, including IBAN, currency of account, bank SWIFT code, and tax/business registration number.

- Complete the declaration section by agreeing to pay back any wrongly obtained funds and confirming the accuracy of the details provided.

- Indicate the nature of your business activities conducted in the UK during the specified period.

- Fill in contact information, including a phone number, fax number, and email address.

- Complete the itemized schedule of VAT amounts relating to the period covered; each document submitted should be numbered consecutively.

- If additional space is needed, use as many VAT65/65A (CS) continuation sheets as required and securely attach them to your application.

- Review all entered information for accuracy, then proceed to save changes, download, print, or share the completed form.

Begin your VAT refund process by completing the UK VAT65A online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To fill out a customs form for the UK, provide details about the items you are sending, including their value and description. Each section must be completed accurately to facilitate customs clearance. If a VAT refund is applicable, make sure you mark it clearly when using UK VAT65A. A well-prepared customs form significantly speeds up processing time.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.