Loading

Get Uk Hmrc Eis/seis(aa) 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

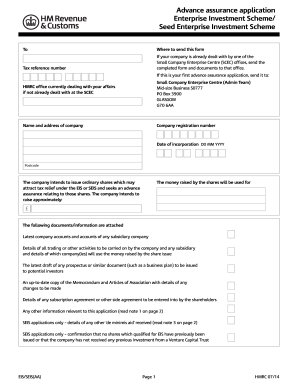

How to fill out the UK HMRC EIS/SEIS(AA) online

This guide provides a clear, step-by-step approach to completing the UK HMRC EIS/SEIS(AA) form online. By following these instructions, users can ensure they provide the necessary information accurately and efficiently.

Follow the steps to successfully fill out the form.

- Click the 'Get Form' button to obtain the EIS/SEIS(AA) form and open it in the document editor.

- Fill in the company name and address at the top of the form. Ensure the details are accurate to avoid complications later.

- Enter the company's registration number and the date of incorporation using the DD MM YYYY format.

- Provide the postcode for the registered address of the company.

- Clearly state the amount of money the company intends to raise through the issuance of ordinary shares.

- Describe how the money raised from the shares will be utilized by the company.

- Attach required documents, including the latest company accounts, information on trading activities, any relevant prospectus, and memorandum and articles of association.

- Include any agreements related to the issuance of shares, along with relevant details about any received 'de minimis aid' (for SEIS applications).

- Complete the declaration section, ensuring that the full name is written in capital letters, and indicate the capacity in which the form is signed (such as director or authorized person).

- Finally, review all the information to ensure its accuracy, then save your changes, and choose whether to download, print, or share the completed form.

Complete your EIS/SEIS(AA) application online today.

Eligible individuals for tax relief in the UK must be UK taxpayers, which includes both income tax and capital gains tax payers. The UK HMRC EIS/SEIS(AA) offers significant benefits to those who invest wisely in small, qualifying companies. This tax relief framework encourages investment in emerging businesses, stimulating economic growth.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.