Get Employer's Withholding Of State Income Tax - Hawaii Tax

How it works

-

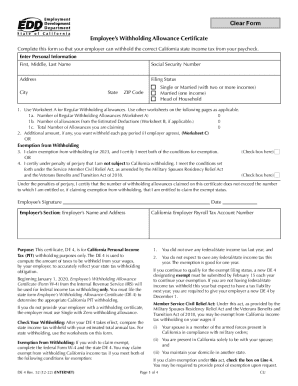

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:Experience all the benefits of completing and submitting legal forms online. Using our platform submitting Employer's Withholding Of State Income Tax - Hawaii Tax usually takes a couple of minutes. We make that possible by giving you access to our full-fledged editor capable of altering/fixing a document?s original text, inserting unique fields, and e-signing.

Execute Employer's Withholding Of State Income Tax - Hawaii Tax in a few clicks by following the guidelines listed below:

- Choose the document template you want from the library of legal forms.

- Select the Get form button to open it and start editing.

- Fill out all the required boxes (they will be marked in yellow).

- The Signature Wizard will allow you to insert your electronic autograph as soon as you?ve finished imputing info.

- Add the relevant date.

- Check the entire form to be certain you have completed all the information and no changes are needed.

- Press Done and download the ecompleted template to your gadget.

Send your Employer's Withholding Of State Income Tax - Hawaii Tax in an electronic form when you are done with completing it. Your information is well-protected, because we adhere to the most up-to-date security requirements. Become one of millions of happy clients who are already filling in legal forms straight from their homes.

An employer generally must withhold Social Security and Medicare taxes from employees' wages and pay the employer share of these taxes. Social Security and Medicare taxes have different rates and only the social security tax has a wage base limit.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.