Loading

Get Ca Re 870 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA RE 870 online

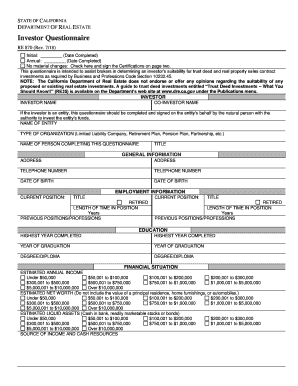

Filling out the CA RE 870 form is an essential step for investors looking to evaluate their suitability for trust deed and real property sales contract investments. This guide provides clear instructions on how to complete each section of the form effectively.

Follow the steps to fill out the CA RE 870 form correctly.

- Use the ‘Get Form’ button to access the CA RE 870 online. This will open the form in your document editor, allowing for ease of completion.

- Begin by filling out the investor's name and, if applicable, the co-investor's name. If the investor is an entity, provide the entity name along with the type of organization and the person authorized to complete the questionnaire.

- Provide the general information such as addresses, telephone numbers, and dates of birth for both the investor and co-investor if applicable.

- In the employment information section, indicate the current position and title for both the investor and co-investor, noting if retired. Include the length of time in the current and previous positions, if relevant.

- Fill out the education section by entering the highest year completed by each individual, year of graduation, and the degree or diploma achieved.

- In the financial situation section, estimate annual income, net worth, and liquid assets by selecting the appropriate range from the provided options.

- Indicate the liquidity needs by selecting one of the options regarding cash needs.

- Report your investment experience by specifying the number of years in various types of investments, including mutual funds, stocks, and real estate.

- Include any other investments or considerations that might impact your suitability as an investor.

- Complete the investment objectives section by clearly stating the goal of investing in trust deeds or real property sales contracts.

- Sign and date the investor and co-investor sections to certify the accuracy of the information provided. The broker will also need to acknowledge the questionnaire.

- Finally, you can save your changes, download the completed form, print it for your records, or share it as necessary.

Start filling out your CA RE 870 online now to ensure you meet investment suitability requirements.

Filing non-resident taxes for California involves completing the required Form 540NR accurately. You must include all California-sourced income, deductions, and credits pertinent to your situation. Following the guidance of the CA RE 870 is crucial for a smooth filing experience. Platforms like USLegalForms are excellent resources for obtaining forms and expert assistance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.