Loading

Get Ca Ftb 2917 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 2917 online

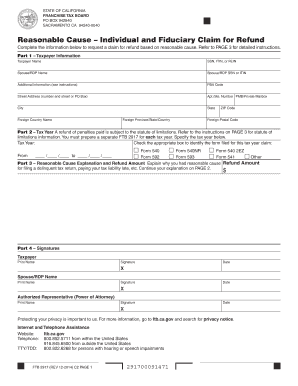

Filling out the CA FTB 2917 form online can be straightforward with the right guidance. This form allows users to request a claim for refund based on reasonable cause, and understanding each section will help ensure accurate and timely submission.

Follow the steps to fill out the CA FTB 2917 form effectively.

- Click ‘Get Form’ button to access the form and open it in the editor.

- In Part 1, enter your taxpayer information accurately, including names, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and address details as they appear on your tax return.

- Complete Part 2 by specifying the tax year for which you are claiming a refund. Note that a separate FTB 2917 must be filled out for each tax year.

- In Part 3, provide a thorough explanation of your reasonable cause for filing a late return or paying late. Include the specific refund amount you are requesting.

- If applicable, complete Part 4 by providing the necessary signatures for the taxpayer, spouse or registered domestic partner, and any authorized representative. Ensure the signatures are dated.

- Review all the information entered for accuracy. Once satisfied, you can save your changes, download the completed form, and choose to print or share as needed.

Complete your forms online with confidence and ensure timely submissions.

Related links form

Use Where's My Refund, call us at 800-829-1954 (toll-free) and use the automated system, or speak with a representative by calling 800-829-1040 (see telephone assistance for hours of operation). If you filed a married filing jointly return, you can't initiate a trace using the automated systems.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.