Loading

Get Az Az-140v 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ AZ-140V online

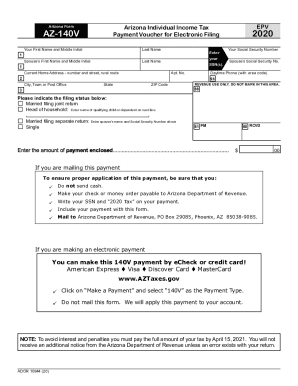

The AZ AZ-140V is an essential form for individuals making payments related to their Arizona individual income tax. Completing this form accurately ensures your payment is processed smoothly and applied to your account without delay.

Follow the steps to accurately complete the AZ AZ-140V online.

- Click ‘Get Form’ button to access the AZ AZ-140V form and open it in your preferred editor.

- Enter your first name and middle initial in the designated field, followed by your last name. If applicable, also include your spouse’s first name, middle initial, and last name.

- Input your Social Security Number (SSN) in the appropriate fields for both you and your spouse, if filing jointly.

- Provide your current home address, including the street number, apartment number if applicable, city or town, state, and ZIP code.

- Select your filing status by marking the appropriate checkbox. Options include married filing jointly, head of household (and include the name of the qualifying child or dependent), married filing separately, or single.

- Enter the amount of payment enclosed in the designated field to ensure the correct payment amount is applied.

- If you are mailing this payment, make sure you follow the specified guidelines: do not send cash, make your check or money order payable to Arizona Department of Revenue, write your SSN and '2020 Tax' on your payment, and mail it to the specified address.

- If you are making an electronic payment, select the option to pay by eCheck or credit card and ensure to click on 'Make a Payment', selecting '140V' as the payment type. Remember, do not mail this form if you choose electronic payment.

- Once all fields are filled, review your entries for accuracy. Finally, save your changes, download, print, or share the form as needed.

Complete your documents online today to ensure timely payment and avoid penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

What are the tax rates in 2022 and 2023? For tax year 2022, there are two individual income tax rates, 2.55% and 2.98%. The new flat tax of 2.5% will affect the 2023 tax year – which is filed by April 2024.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.