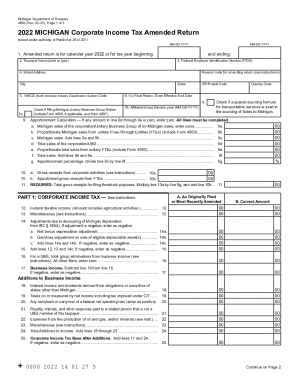

Get Transitioning To The Michigan Corporate Income Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:Choosing a authorized specialist, creating a scheduled visit and coming to the business office for a personal meeting makes finishing a Transitioning To The Michigan Corporate Income Tax from start to finish tiring. US Legal Forms enables you to rapidly produce legally valid papers based on pre-constructed browser-based templates.

Execute your docs within a few minutes using our straightforward step-by-step guide:

- Get the Transitioning To The Michigan Corporate Income Tax you require.

- Open it using the cloud-based editor and start altering.

- Fill out the empty fields; concerned parties names, addresses and phone numbers etc.

- Change the blanks with smart fillable fields.

- Add the date and place your e-signature.

- Simply click Done following double-checking all the data.

- Save the ready-produced record to your gadget or print it out like a hard copy.

Quickly generate a Transitioning To The Michigan Corporate Income Tax without needing to involve experts. We already have more than 3 million customers benefiting from our unique catalogue of legal documents. Join us right now and gain access to the #1 collection of online blanks. Give it a try yourself!

Nevada, South Dakota, and Wyoming have no corporate or individual income tax (though Nevada imposes gross receipts taxes); Alaska has no individual income or state-level sales tax; Florida has no individual income tax; and New Hampshire and Montana have no sales tax.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.