Loading

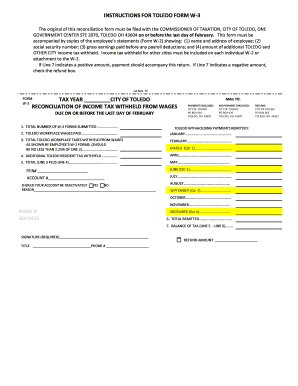

Get Employers Quarterly Return Of Tax ... - Toledo, Ohio

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:The days of terrifying complicated legal and tax documents have ended. With US Legal Forms the entire process of filling out legal documents is anxiety-free. The leading editor is already at your fingertips supplying you with a range of useful instruments for submitting a EMPLOYERS QUARTERLY RETURN OF TAX ... - Toledo, Ohio. The following tips, combined with the editor will help you with the whole procedure.

- Select the Get Form option to start editing.

- Switch on the Wizard mode on the top toolbar to have additional tips.

- Fill every fillable field.

- Make sure the information you add to the EMPLOYERS QUARTERLY RETURN OF TAX ... - Toledo, Ohio is updated and accurate.

- Indicate the date to the form with the Date function.

- Click the Sign button and make an electronic signature. You will find three available options; typing, drawing, or capturing one.

- Double-check each and every area has been filled in properly.

- Click Done in the top right corne to export the record. There are various ways for receiving the doc. An attachment in an email or through the mail as a hard copy, as an instant download.

We make completing any EMPLOYERS QUARTERLY RETURN OF TAX ... - Toledo, Ohio easier. Start now!

All residents and non-residents working in Toledo who have earned income are subject to the 2.5% City of Toledo income tax regardless of age.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.