Loading

Get Estimated Tax Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Estimated Tax Worksheet online

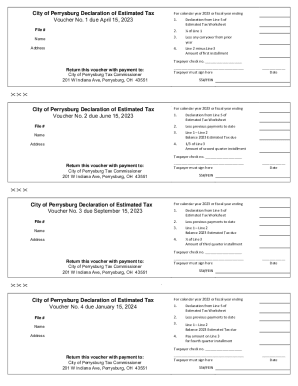

The Estimated Tax Worksheet is a crucial document for individuals and businesses estimating their tax liabilities. This guide provides clear, easy-to-follow steps to help you complete the form accurately online.

Follow the steps to fill out the Estimated Tax Worksheet online.

- Click ‘Get Form’ button to access the Estimated Tax Worksheet and open it in the online editor.

- In the first section of the form, enter the declaration from Line 5 of the Estimated Tax Worksheet. This figure represents your total estimated tax liability for the year.

- Next, calculate one-fourth of the amount entered in Step 2. This value will indicate the first installment amount required.

- If applicable, subtract any carryover from the prior year from the total estimated tax liability. This adjustment will provide a more accurate figure for your current tax due.

- Deduct the amount calculated in Step 4 from the amount in Step 2 to determine your first installment amount.

- For the first quarter voucher, fill in your name, address, and taxpayer identification information. Be sure to sign and date the voucher before submission.

- Repeat steps 2-6 for the remaining vouchers, adjusting for any previous payments made to date. Ensure the calculations reflect the balance due for each subsequent installment.

- Once all sections are completed, you can save changes, download, print, or share the form as needed.

Complete your Estimated Tax Worksheet online today for a smoother tax filing experience.

If you can't pay your debt right away, you can schedule a series of payments in the My Account / My Business Account portals using a pre-authorized debit (PAD) agreement. A PAD is a secure, online payment option to pay your debt. Arrange to pay your personal debt over time - Payments to the CRA canada.ca https://.canada.ca › services › payment-arrangements canada.ca https://.canada.ca › services › payment-arrangements

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.