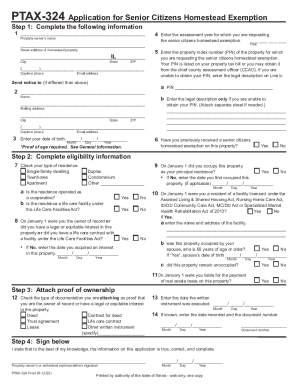

Get Fillable Ptax-324 Application For Senior Citizens Homestead Exemption

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:The days of terrifying complex tax and legal forms have ended. With US Legal Forms the entire process of submitting official documents is anxiety-free. A powerhouse editor is right at your fingertips providing you with an array of useful tools for completing a Fillable PTAX-324 Application For Senior Citizens Homestead Exemption. These tips, together with the editor will help you through the complete process.

- Click the Get Form button to begin editing and enhancing.

- Activate the Wizard mode on the top toolbar to have more pieces of advice.

- Fill in each fillable area.

- Make sure the info you add to the Fillable PTAX-324 Application For Senior Citizens Homestead Exemption is updated and accurate.

- Indicate the date to the document with the Date feature.

- Click the Sign icon and create an electronic signature. You can find three available choices; typing, drawing, or uploading one.

- Check once more every field has been filled in properly.

- Select Done in the top right corne to save or send the document. There are several choices for receiving the doc. As an instant download, an attachment in an email or through the mail as a hard copy.

We make completing any Fillable PTAX-324 Application For Senior Citizens Homestead Exemption easier. Use it now!

The Senior Citizen Homestead Exemption reduces the assessed value of your property by $5,000 and is available for a residence owned and occupied by a person 65 or older during the tax year. If you qualify and do not receive this exemption, contact the Board of Review at (618) 277-6600, ext. 2489, 2493, 2488.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.