Loading

Get Irs 1042 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1042 online

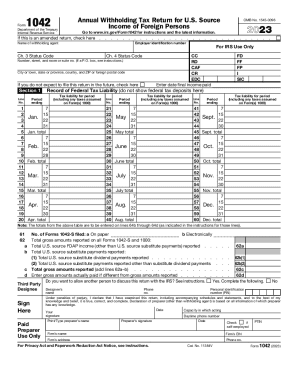

The IRS 1042 form is the annual withholding tax return for U.S. source income of foreign persons. Filling out this form accurately is essential for compliance with U.S. tax laws and for reporting taxes withheld on payments made to foreign entities. This guide provides a step-by-step approach to completing the IRS 1042 online.

Follow the steps to complete your IRS 1042 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the basic information, including the chapter 3 status code and chapter 4 status code, if applicable.

- Input the name, address, and employer identification number (EIN) of the withholding agent. This should include the full street address, city, state, and ZIP code.

- Complete Section 1 by entering the tax liabilities for each reporting period, ensuring you report all amounts accurately.

- In Section 2, report the number of Forms 1042-S filed and the total gross amounts reported. Ensure that totals are calculated correctly.

- Proceed to Section 3 to handle any potential Section 871(m) transactions. Check the box if applicable and provide any required explanations.

- For Section 4, if any payments were made by a Qualified Derivatives Dealer, check the box and ensure to attach the necessary schedules as per the instructions.

- Complete the signature block at the end of the form, including your name, title, and date of signing.

- After reviewing all the information for accuracy, users can save changes, download a copy, print, or share the form as necessary.

Start completing your IRS 1042 form online today to ensure timely filing.

The Benefits and Disadvantages of 1042-s vs W2 Any foreign nationals, non-U.S. residents, and other foreign entities who received wages that were not subject to federal or state taxes will receive a 1042-S from their employer. Conversely, employees who are U.S. citizens receive a W2 from employers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.