Loading

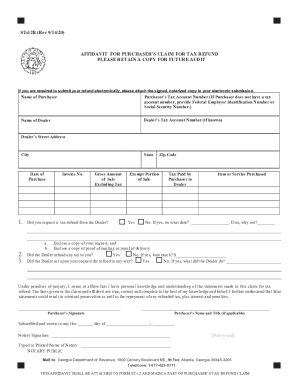

Get Ga St-12b 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Once the DOR files a tax lien, they have ten years from that date to collect the unpaid taxes. The 10-year time clock may be tolled (paused) under certain circumstances. For example, when the taxpayer is in a Payment Agreement with the DOR or when the taxpayer has filed bankruptcy. Georgia State Tax Resolution Options for Taxes Owed - TaxCure taxcure.com https://taxcure.com › state-taxes › georgia taxcure.com https://taxcure.com › state-taxes › georgia

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.