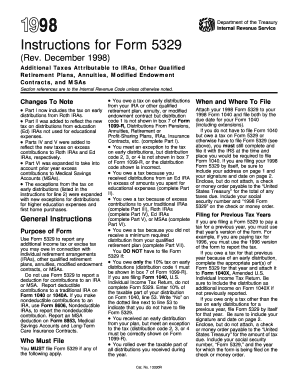

Get 1998 Instructions 5329. Additional Taxes Attributable To Iras, Other Qualified Retirement Plans

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign vii online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Have you been searching for a quick and convenient solution to complete 1998 Instructions 5329. Additional Taxes Attributable To IRAs, Other Qualified Retirement Plans at a reasonable price? Our platform provides you with a rich selection of forms that are available for completing on the internet. It takes only a couple of minutes.

Keep to these simple instructions to get 1998 Instructions 5329. Additional Taxes Attributable To IRAs, Other Qualified Retirement Plans completely ready for sending:

- Select the sample you require in our library of templates.

- Open the document in the online editor.

- Look through the guidelines to discover which information you need to include.

- Select the fillable fields and put the required information.

- Add the relevant date and insert your e-signature when you fill in all other fields.

- Look at the completed document for misprints and other mistakes. In case you necessity to correct some information, our online editor as well as its wide range of instruments are at your disposal.

- Download the filled out form to your device by clicking Done.

- Send the electronic form to the parties involved.

Submitting 1998 Instructions 5329. Additional Taxes Attributable To IRAs, Other Qualified Retirement Plans doesn?t have to be confusing anymore. From now on simply get through it from home or at the place of work from your mobile device or PC.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Expectancies FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to 1998 Instructions 5329. Additional Taxes Attributable To IRAs, Other Qualified Retirement Plans

- MSA

- 1099-R

- nondeductible

- vii

- I--Tax

- 15b

- expectancies

- 1040x

- 16b

- nondiscrimination

- allocable

- AGI

- recordkeeping

- 13330R

- deferrals

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.