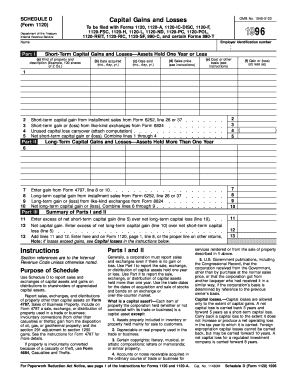

Get Schedule D (form 1120) Department Of The Treasury Internal Revenue Service Capital Gains And Losses

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign 1120-ND online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:The days of terrifying complex legal and tax documents have ended. With US Legal Forms the procedure of filling out official documents is anxiety-free. The leading editor is right at your fingertips giving you a wide variety of useful tools for completing a SCHEDULE D (Form 1120) Department Of The Treasury Internal Revenue Service Capital Gains And Losses. These guidelines, together with the editor will guide you through the complete procedure.

- Hit the orange Get Form option to start editing and enhancing.

- Turn on the Wizard mode in the top toolbar to obtain more recommendations.

- Fill in each fillable field.

- Ensure the details you add to the SCHEDULE D (Form 1120) Department Of The Treasury Internal Revenue Service Capital Gains And Losses is updated and accurate.

- Add the date to the record using the Date feature.

- Click the Sign icon and make a digital signature. You can find 3 available options; typing, drawing, or capturing one.

- Re-check each area has been filled in properly.

- Select Done in the top right corne to save the form. There are several choices for receiving the doc. An attachment in an email or through the mail as a hard copy, as an instant download.

We make completing any SCHEDULE D (Form 1120) Department Of The Treasury Internal Revenue Service Capital Gains And Losses faster. Use it now!

Use Schedule D (Form 1040) to report the following: The sale or exchange of a capital asset not reported on another form or schedule. Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.