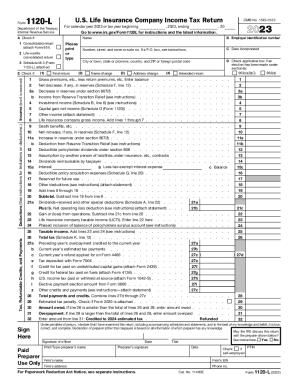

Get Treasury And Irs Propose New Tax Form For Corporate ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Are death benefits taxable to beneficiary online

How to edit Schedule l 1120: customize forms online

Approve and share Schedule l 1120 along with any other business and personal paperwork online without wasting time and resources on printing and postal delivery. Take the most out of our online document editor with a built-in compliant electronic signature option.

Signing and submitting Schedule l 1120 documents electronically is faster and more effective than managing them on paper. However, it requires using online solutions that guarantee a high level of data safety and provide you with a compliant tool for creating eSignatures. Our powerful online editor is just the one you need to complete your Schedule l 1120 and other personal and business or tax forms in a precise and appropriate way in accordance with all the requirements. It features all the essential tools to easily and quickly fill out, edit, and sign paperwork online and add Signature fields for other people, specifying who and where should sign.

It takes only a few simple actions to complete and sign Schedule l 1120 online:

- Open the chosen file for further managing.

- Make use of the top toolkit to add Text, Initials, Image, Check, and Cross marks to your sample.

- Underline the most significant details and blackout or erase the sensitive ones if necessary.

- Click on the Sign option above and select how you prefer to eSign your form.

- Draw your signature, type it, upload its image, or use another option that suits you.

- Switch to the Edit Fillable Fileds panel and drop Signature areas for other parties.

- Click on Add Signer and type in your recipient’s email to assign this field to them.

- Check that all information provided is complete and accurate before you click Done.

- Share your documentation with others using one of the available options.

When approving Schedule l 1120 with our powerful online solution, you can always be sure to get it legally binding and court-admissible. Prepare and submit documents in the most effective way possible!

This is the government's way of ensuring that you pay at least a minimum amount of tax. AMT liability is determined in a separate tax computation based on your “adjusted taxable income”. Adjusted taxable income is determined by taking your net taxable income and adjusting for certain “tax preference items”.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.