Loading

Get Irs 4506 (sp) 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 4506 (SP) online

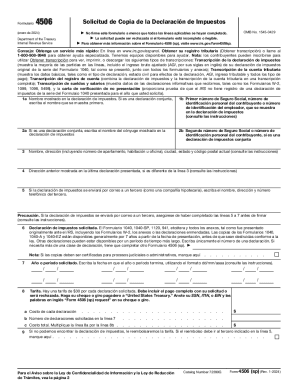

The IRS Form 4506 (SP) is used to request a copy of your tax return filed with the Internal Revenue Service. This guide will provide you with clear, step-by-step instructions to help you fill out the form online, ensuring that you complete it accurately and efficiently.

Follow the steps to complete the IRS 4506 (SP) form online.

- Click 'Get Form' button to access the form and open it in the editor.

- Enter the name shown on your tax return in Line 1a. For a joint return, write the name of the first person listed.

- For Line 1b, provide the first Social Security number, Individual Taxpayer Identification Number, or Employer Identification Number as it appears on your tax return.

- If you're filing a joint return, enter your spouse's name in Line 2a as it appears on the tax return.

- In Line 2b, write your spouse's Social Security number or ID number if applicable.

- Fill out Line 3 with your current address, ensuring to include any apartment, suite, or office number.

- If your address has changed from the last tax return, complete Line 4 with your previous address.

- If you are sending this form to a third party, fill out Line 5 with their name, address, and phone number.

- For Line 6, indicate the type of tax return requested, such as Form 1040, 1120, or other relevant forms.

- In Line 8, specify the year or period for which you are requesting a tax return, using the format mm/dd/yyyy.

- Be aware that there is a fee of $30 for each tax return requested. Ensure you include your payment with the application, as missing payments can lead to rejection.

- Complete the necessary fields regarding payment in Lines 8a, 8b, and calculate the total in Line 9.

- Do not sign the form until all applicable lines are filled out. Ensure you review the form for completeness.

- Sign and date the form where indicated at the bottom of the second page, making sure to mark any necessary boxes indicating your authority to sign.

- Once completed, save any changes, and download or print the form for submission.

Complete your IRS 4506 (SP) form online now for a seamless tax return request process.

You may use Get Transcript by Mail or you may call our automated phone transcript service at 800-908-9946 to order a tax return or tax account transcript be sent by mail. Please allow 5 to 10 calendar days from the time we receive your request for your transcript to arrive.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.