Loading

Get Fl Dr-15n 2024-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-15N online

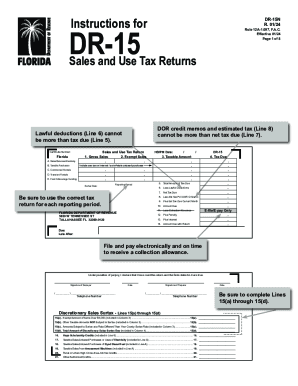

The FL DR-15N form is essential for reporting sales and use tax in Florida. This guide provides a clear, step-by-step approach to assist users in accurately completing the form online.

Follow the steps to fill out the FL DR-15N form online.

- Press the ‘Get Form’ button to access the FL DR-15N form and open it in your editing tool.

- Enter your Certificate Number at the top of the form. This number is essential for identifying your tax account.

- In Section A for Sales/Services/Electricity, input your Gross Sales in Column 1 and Exempt Sales in Column 2. Calculate your Taxable Amount for Column 3 by subtracting exempt sales from gross sales.

- Fill in Column 4 by calculating the Tax Due based on your taxable amounts. Include all applicable tax rates.

- Continue filling in the other sections — B for Taxable Purchases, C for Commercial Rentals, D for Transient Rentals, and E for Food & Beverage Vending — following the same process of entering gross sales and calculating taxable amounts.

- Once all fields are completed, review the totals on Lines 5 through 14 for accuracy before proceeding.

- At the end of the form, don’t forget to sign and date the return. If applicable, include the signature of any preparer.

- Finally, save your changes, and choose to download, print, or share the completed form as necessary.

Complete your FL DR-15N online today to ensure accurate and timely filing.

Lawful deductions include tax refunded by you to your customers for returned goods or allowances for damaged merchandise, tax paid by you on purchases of goods intended for use or consumption but sold by you instead, Hope Scholarship Credits, and any other deductions allowed by law.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.