Loading

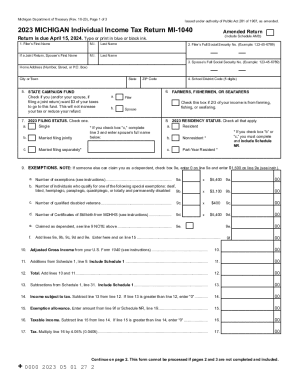

Get Mi Mi-1040 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign 2005 mi1040 fillable online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:Getting a authorized expert, making a scheduled appointment and coming to the office for a personal conference makes doing a MI MI-1040 from start to finish tiring. US Legal Forms allows you to rapidly make legally-compliant documents according to pre-built browser-based samples.

Perform your docs in minutes using our straightforward step-by-step instructions:

- Find the MI MI-1040 you need.

- Open it with cloud-based editor and begin editing.

- Fill the empty areas; concerned parties names, addresses and numbers etc.

- Customize the template with unique fillable areas.

- Add the day/time and place your e-signature.

- Click Done following double-checking all the data.

- Save the ready-produced document to your system or print it out as a hard copy.

Swiftly create a MI MI-1040 without needing to involve professionals. We already have more than 3 million people benefiting from our rich library of legal documents. Join us right now and get access to the #1 library of web templates. Try it out yourself!

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.