Loading

Get Ny Dtf-664 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF-664 online

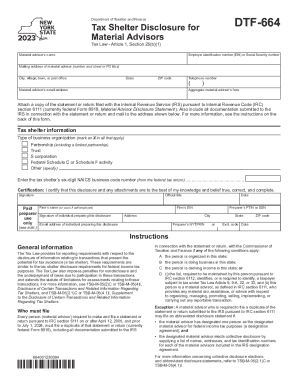

Filing the NY DTF-664 form online is a crucial step for individuals acting as material advisors under New York State tax laws. This guide provides clear instructions on how to complete each section of the form accurately and efficiently, ensuring compliance with tax regulations.

Follow the steps to fill out the NY DTF-664 effectively.

- Press the 'Get Form' button to obtain the form and open it in your editing tool of choice.

- Enter the material advisor’s name at the top of the form, followed by their employer identification number (EIN) or Social Security number.

- Provide the mailing address of the material advisor, including the street number, city, state, and ZIP code.

- Fill in the material advisor’s telephone number and email address for contact purposes.

- Input the aggregate amount of fees received by the material advisor. This includes all relevant fees as specified under IRC sections.

- Attach a copy of the statement or return filed with the IRS, including any associated documentation.

- Indicate the type of business organization by marking an X in the applicable boxes (e.g., partnership, S corporation). If applicable, specify 'Other' and describe the organization.

- Enter the six-digit NAICS business code number associated with the tax shelter from the federal tax return.

- Certification is required. Sign the form to certify that the information provided is true, correct, and complete.

- If a paid preparer is used, they must sign in the designated section and provide their details, including their PTIN or SSN.

- After completing the form, review all entered information for accuracy. Save your changes.

- Download, print, or share the completed form as necessary for submission.

Complete your forms online today for a more efficient filing experience!

That is, New York tax liens have a 20 year statute of limitations). So, while the State has six years from the time of assessment to file a tax warrant, the related lien remains in place for 20 years once the warrant has been filed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.