Loading

Get Ok 511-nr Packet 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK 511-NR Packet online

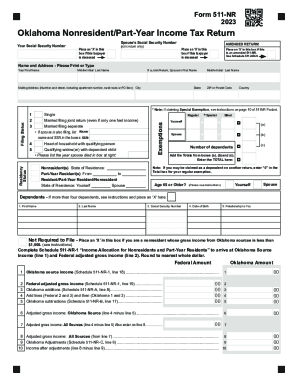

The OK 511-NR Packet is essential for nonresidents and part-year residents to file their individual income tax in Oklahoma. This guide offers clear, step-by-step instructions on completing the online form efficiently and accurately.

Follow the steps to complete the OK 511-NR Packet online:

- Press the 'Get Form' button to access the OK 511-NR Packet. This action will open the form in your preferred digital editor.

- Begin by filling in your personal details including your name, address, and Social Security number as indicated on the form. If applicable, include your spouse's information here.

- Indicate your filing status by checking the appropriate box based on your situation: single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Next, input your residency status by specifying whether you are a nonresident, part-year resident, or otherwise. Include the state of residence for accuracy.

- Proceed to the exemptions section. Calculate the total number of exemptions you are eligible for and record this amount on the form.

- Complete Schedule 511-NR-1 to calculate your Oklahoma source income and federal adjusted gross income. Transfers of figures should be made as detailed in the instructions.

- Move to Schedule 511-NR-A to report any Oklahoma allowable additions and then to Schedule 511-NR-B for subtractions.

- Continue to Schedule 511-NR-C for adjustments related to military pay, disability deduction, and contributions to a 529 plan, if applicable.

- Review the Oklahoma itemized deductions on Schedule 511-NR-D, ensuring to follow previous deductions claimed on your federal return.

- Input your Oklahoma tax from the provided tables, adjusting for any applicable credits such as child care or earned income credits as indicated.

- Finally, review all inputted information for accuracy. Save your changes and download or print the completed form, ensuring all necessary schedules are attached.

Complete your OK 511-NR Packet online for an efficient and faster tax filing experience.

Oklahoma State Tax Payment Options Description:Go to the Oklahoma TAP site to submit your payment. Make sure you select "Individual Income Tax" as the account type, and "Return Payment" as your payment type. Additional Information:This is a free option if you want to pay your taxes owed via your bank account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.