Loading

Get Ny Bc-7q 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY BC-7Q online

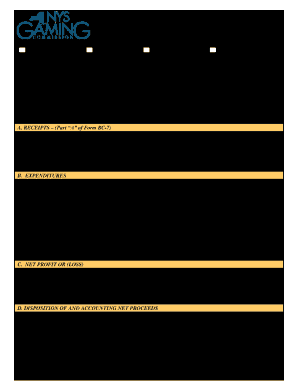

The NY BC-7Q is an essential quarterly statement form for bingo operations conducted by organizations in New York. This guide will provide clear and comprehensive instructions on how to fill out this form correctly online, ensuring compliance with state requirements.

Follow the steps to successfully complete your NY BC-7Q form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Indicate the calendar year for which you are filing by filling in the relevant year next to 'CALENDAR YEAR: _________'.

- Select the appropriate quarter by marking one of the options: January 1st – March 31st, April 1st – June 30th, July 1st – September 30th, or October 1st – December 31st.

- Enter the name of your organization, Bingo ID, and license number in the designated fields.

- Complete the address section with the street, city, state, and zip code where your organization is located.

- Fill in the number of occasions and number of players for the reporting period.

- Part A records all receipts: provide details for total bingo receipts, total sale of supplies, and any other receipts. Add these amounts to obtain total receipts.

- Part B requires you to detail expenditures: list the total prizes, rent (if applicable), license fees, bingo equipment, services, and other expenses. Sum these to derive total expenditures.

- In Part C, calculate net profit or loss. Complete line C1 by deducting total expenditures from total receipts. Fill out any additional license fee on line C2 and calculate total net profit or loss on line C3.

- Part D covers the disposition of net proceeds. Enter the unexpended balance from the last BC-7Q, net profit or loss from this period, interest earned, and any adjustments in the Special Bingo Account. Add these to get total net proceeds.

- Complete Part E by detailing total disbursements of net proceeds from the special bingo account since your last report.

- Part F requires you to calculate the unexpended balance of net proceeds.

- Prepare and attach a list of all disbursement checks of net proceeds before signing the affirmation at the bottom of the form.

- Ensure all required signatures are included. The head of the organization, member in charge, and preparer must sign and date the form, including their contact information.

- Once completed, save changes, download the filled form, and print or share it as necessary.

Complete your NY BC-7Q form online today to ensure compliance with New York state regulations.

Yes, to host bingo in New York, you need a valid license. This ensures that the bingo games comply with state laws and regulations. The application process usually involves submitting details about your organization and the purpose of the games. Utilizing services such as USLegalForms can simplify this process and help you secure your NY BC-7Q license efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.