Loading

Get Ny Es 161.5 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY ES 161.5 online

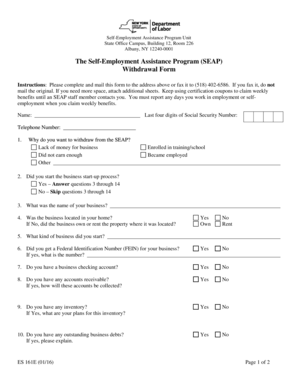

The NY ES 161.5 form is essential for individuals participating in the Self-Employment Assistance Program who wish to withdraw from the program. This guide will provide clear, step-by-step instructions on how to complete this form online, ensuring accuracy and compliance with the requirements.

Follow the steps to complete the NY ES 161.5 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name in the designated field at the top of the form.

- Provide the last four digits of your Social Security Number in the appropriate section.

- Fill in your telephone number to ensure communication.

- Indicate your reason for withdrawing from the SEAP by checking the appropriate box, such as lack of money for business or becoming employed.

- State whether you started the business start-up process by selecting 'Yes' or 'No'. If you answer 'Yes', continue to answer questions 3 through 14.

- If applicable, write the name of your business.

- Indicate if your business was located in your home by selecting 'Yes' or 'No'. If 'No', specify whether the business owned or rented the property.

- If you obtained a Federal Identification Number (FEIN) for your business, state 'Yes' and provide the number, or select 'No'.

- Indicate whether you have a business checking account by selecting 'Yes' or 'No'.

- If you have accounts receivable, indicate 'Yes' and describe how these accounts will be collected, or select 'No'.

- If you have inventory, indicate 'Yes' and outline your plans for the inventory, or select 'No'.

- Indicate if you have any outstanding business debts and provide an explanation if applicable.

- Mention any other business obligations you may have, specifying details if you answer 'Yes'.

- Indicate if you purchased any equipment for your business and describe your plans for that equipment if applicable.

- State whether you promoted your business and provide details if you answer 'Yes'.

- If you are still performing any activity related to your business, select 'Yes' and explain. If 'No', indicate when you stopped activities.

- Provide any comments or feedback about the SEAP program if desired.

- Finally, certify that the information provided is true by signing and dating the form.

- After completing all fields, save your changes, download the document, print it for submission, or share as required.

Complete your withdrawal form online today for a smooth process.

Related links form

In New York, new employees are required to fill out several fundamental forms. These include the W-4 for federal income tax, the NYS-1 for state tax, and the I-9 to confirm their eligibility to work. By leveraging services like NY ES 161.5, employers can streamline the collection and management of these necessary forms, making the onboarding process more efficient.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.