Get Ny F556 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY F556 online

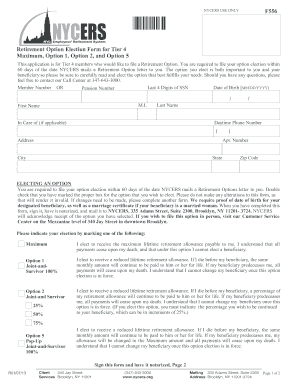

The NY F556 Retirement Option Election Form is essential for Tier 4 members looking to select their retirement payment option. This guide will help you navigate the process of completing the form online, ensuring that you make an informed decision regarding your retirement benefits.

Follow the steps to fill out the NY F556 online

- Press the ‘Get Form’ button to retrieve the form and open it in the online editor.

- Begin by entering your personal information, including your member number or the last four digits of your Social Security Number, date of birth, pension number, first name, middle initial, last name, and any applicable in-care-of name.

- Provide your daytime phone number and complete your address, including any apartment number, city, state, and zip code.

- Indicate your retirement option by marking the appropriate box for the Maximum, Option 1, Option 2, or Option 5. Ensure that you double-check this selection as it is vital for your benefit plan.

- If you select Option 2, specify the percentage of your retirement allowance that you wish to continue to be paid to your beneficiary, in increments of 25%.

- Complete the beneficiary information section by entering the beneficiary's full name, Social Security number, date of birth, relationship, and address.

- If your beneficiary is a minor, check the designated box and ensure to complete the guardian information on Form 137.

- Review all of the information provided on the form for accuracy.

- Sign the form and have it notarized to ensure its validity.

- Once completed, save changes and download the form, or print it for mailing to NYCERS at the specified address.

Complete your retirement option election online today to secure your benefits!

Get form

To fill out your tax withholding form effectively, begin with your personal details, such as your Social Security number and address. Next, indicate your filing status and the number of allowances you’re claiming based on your tax situation. It's essential to ensure accuracy, as this will affect your final tax bill. For additional help, NY F556 resources from USLegalForms can provide guidance tailored to your needs.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.