Loading

Get Form 571 L Marin County 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 571 L Marin County 2013 online

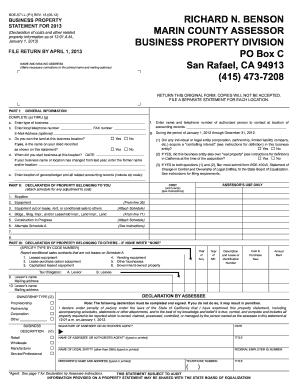

Filling out the Form 571 L for Marin County is an essential requirement for declaring business property. This guide offers step-by-step instructions to assist you in completing the form accurately and effectively online.

Follow the steps to complete your Form 571 L online.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- In the name and mailing address section, ensure to correct any preprinted information as necessary to reflect your current details.

- For Part I: General Information, complete items (a) through (g) including your business type, contact number, and general ledger location.

- In Part II: Declaration of Property Belonging to You, report the cost of supplies and equipment. Follow the specific instructions for each line accurately.

- Proceed to Part III: Declaration of Property Belonging to Others, and report any leased equipment or property belonging to another entity with necessary details.

- Finalize the form by completing the Declaration by Assessee section, ensuring your signature or that of your authorized agent is included.

- Once all sections are completed, you can save your changes, download the completed form, print it out for submission, or share it as needed.

Complete your Form 571 L online now to ensure timely submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Proposition 19, affecting Marin County, addresses property tax rules regarding inherited properties and provides some tax relief for eligible homeowners. It can influence how properties are assessed and taxed when they change hands. Understanding Prop 19 is important for homeowners, especially when dealing with forms like the Form 571 L Marin County 2013, as it can impact overall property tax responsibilities.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.