Loading

Get Tx Form 21.15 - Harris County 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Form 21.15 - Harris County online

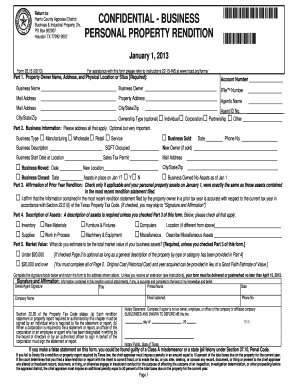

This guide provides a clear and detailed process for completing the TX Form 21.15, designed for business personal property rendition in Harris County. Follow the steps to ensure that your form is filled out accurately and submitted online with ease.

Follow the steps to complete the TX Form 21.15 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the required account number and provide the business name, business owner name, and their address in Part 1. Make sure to include the physical location of the business.

- In Part 2, indicate the type of business along with optional details such as phone number and specifics about ownership (e.g., corporation or partnership). If the business sold, include the sale date and new owner's information.

- If applicable, check the affirmation in Part 3 only if your current property assets match those in the prior year's rendition.

- For Part 4, provide a detailed description of all assets unless you skipped to the signature section due to checking Part 3. Ensure to check all that apply.

- Complete Part 5 by estimating the total market value of your business assets. This is a required field unless you checked Part 3.

- If your assets are valued over $20,000, proceed to complete Page 2 with detailed information about your inventory and fixed assets in Parts 6 and 7.

- Fill out any applicable sections for personal property leased, loaned, consigned, or rented in Parts 8 and 9.

- Review the entire form for accuracy, then complete the signature section at the end. Ensure that you include your printed name, title, company name, phone number, and the date of completion.

- Finally, save the changes to your document. You can then download, print, or share the form as needed, ensuring it's submitted by the deadline.

Complete your TX Form 21.15 online to ensure timely processing of your business property rendition.

To remove personal information from the Harris County Tax Office website, you need to contact the office directly and request the removal. Be prepared to provide the necessary identification and details about the information you wish to remove. Using the services offered on platforms like uslegalforms can help guide you through the proper procedures to ensure your privacy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.