Get Fr Rendita 126436 Form 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FR Rendita 126436 Form online

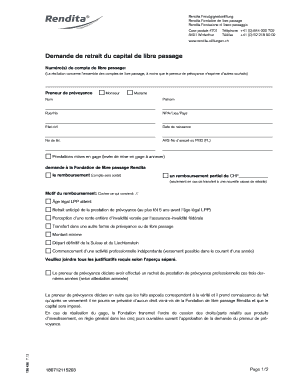

The FR Rendita 126436 Form is an essential document for individuals seeking to withdraw their capital from a pension fund. This guide provides detailed, step-by-step instructions for completing the form online, ensuring a smooth and efficient process.

Follow the steps to fill out the FR Rendita 126436 Form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your account number(s) relevant to the pension fund. This field requires precise information as it identifies your account for withdrawal.

- In the section for the 'Preneur de prévoyance' (policyholder), indicate your title by selecting either ‘Monsieur’ or ‘Madame’. Following that, fill in your name, surname, address (street and number), postal code, and country.

- Provide your civil status, date of birth, telephone number, and AVS number or insured number. This information is important for identification purposes.

- Indicate your desired withdrawal option by checking the appropriate box: full refund, partial refund with specified amount, or other options as listed. Carefully select the reason for your request that applies to your situation.

- Ensure you upload any required supporting documents as indicated within the form. This could include copies of identification, proof of residence, and relevant attestations.

- Review your entries and ensure all information is accurate. Signing the form is necessary — both the policyholder's and, if applicable, the partner’s signature should be included where required.

- Once you have completed the form, you can save changes, download it for your records, print it, or share it as necessary.

Start filling out your FR Rendita 126436 Form online today!

Get form

The best number of deductions to claim on your W4 depends on your financial circumstances and tax situation. Claiming too few deductions could lead to a large refund, while claiming too many may result in owing taxes when you file. It's often advisable to use a withholding calculator to help determine your optimal number of deductions. Consider resources like the FR Rendita 126436 Form on USLegalForms to better understand and manage your tax deductions.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.