Loading

Get Deferred Payment Agreement (dpa)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Deferred Payment Agreement (DPA) online

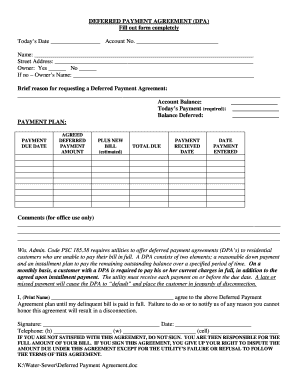

The Deferred Payment Agreement (DPA) is designed to assist users who are unable to pay their utility bill in full. This guide will provide you with clear, step-by-step instructions on how to complete the DPA online to ensure a smooth process.

Follow the steps to successfully complete your Deferred Payment Agreement.

- Press the 'Get Form' button to retrieve the Deferred Payment Agreement and open it in your document editor.

- Fill in today’s date and your account number in the designated fields.

- Enter your full name and street address in the appropriate sections.

- Indicate whether you are the owner of the account by selecting 'Yes' or 'No.' If you select 'No,' provide the owner’s name.

- Write a brief reason for requesting the Deferred Payment Agreement in the provided space.

- Input your current account balance and the required payment amount for today in the respective fields.

- Detail the payment plan by completing the section that includes payment due dates, agreed deferred payment amounts, and the estimated total due.

- Complete the comments section for internal office use if necessary.

- Print your name, sign the agreement, and write the date you are signing.

- Fill in your telephone numbers in the provided fields for contact purposes.

- Review the document carefully to ensure all fields are completed accurately before submitting.

- After completing the form, you can save your changes, download, print, or share the document as needed.

Complete your Deferred Payment Agreement online today for seamless processing.

Typically, the IRS takes about 30 days to process an installment agreement, such as a Deferred Payment Agreement (DPA). However, this timeframe can vary based on your circumstances and the specific information provided in your application. By ensuring your documents are in order, you can potentially expedite this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.