Loading

Get Nbs 403-205fbc 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NBS 403-205FBC online

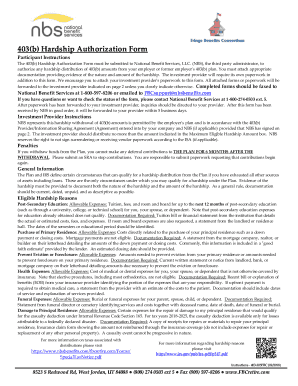

Filling out the NBS 403-205FBC online is an essential process for authorizing hardship distributions from your 403(b) plan. This guide provides clear and detailed instructions to assist you in completing the form accurately and effectively.

Follow the steps to fill out the NBS 403-205FBC online

- To obtain the NBS 403-205FBC form, press the ‘Get Form’ button to access the document in your preferred online editor.

- Begin by entering your participant information, including your name, Social Security number, mailing address, phone number, email address, and date of birth.

- Indicate your school district or former school district, and provide your broker or financial advisor’s name and phone number.

- In the 'Hardship Reason' section, specify the nature of the hardship you are facing. List the relevant reasons such as medical expenses, education costs, or mortgage issues, as applicable.

- Complete the 'Investment Provider Information' section by specifying the investment provider from whom the 403(b) amounts will be withdrawn. Include the account number and the mailing address.

- In the 'Hardship Amount and Participant Approval' section, certify that you do not have other sources of assets to address the financial hardship and specify the requested hardship amount.

- Sign and date the form to confirm the information provided is accurate and complete, acknowledging that it will be shared with authorized third parties.

- Review the completed form to ensure all fields have been accurately filled out, and attach any necessary documentation to support your hardship request.

- Finally, save your changes to the form, and utilize options to download, print, or share the document as needed.

Complete your NBS 403-205FBC form online today to ensure a smooth hardship distribution process.

Aiming to contribute between 10% and 15% of your income into your 403b is a smart strategy. This amount helps you balance your present financial needs while also saving for the future. With the NBS 403-205FBC, you can easily manage your contributions and enhance your retirement planning.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.