Get Canada Fin-400 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada FIN-400 online

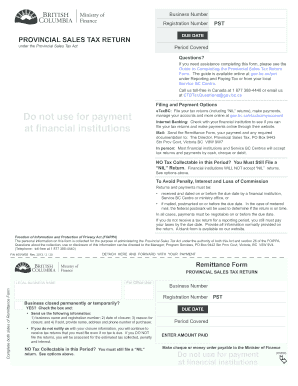

Completing the Canada FIN-400 is essential for businesses to report their provincial sales tax obligations accurately. This guide provides clear, step-by-step instructions on how to fill out the form online, ensuring that you meet all necessary requirements and deadlines.

Follow the steps to successfully complete the Canada FIN-400 form.

- Press the ‘Get Form’ button to access the Canada FIN-400 form and open it in the designated online editor.

- In the form, provide your legal business name as indicated. This should match the name registered with the relevant governmental authorities.

- Enter your business number and registration number in the specified fields. Make sure these are accurate to avoid issues in processing your return.

- Indicate if your business is closed permanently or temporarily by checking the appropriate box. If yes, provide the necessary details including the name, registration number, date of closure, and reason for closure.

- For the period covered, specify the time frame that your return is accounting for. Ensure this aligns with your sales and purchase records.

- Proceed to fill out the Total Sales and Leases. Report your taxable, non-taxable, and exempt sales in Box A.

- Fill in Boxes D, E, and F with the information regarding the tax due on purchases and leases for your business. Make sure all adjustments are documented correctly.

- Review all the fields and ensure accuracy, then save your changes. You can download, print, or share the completed form according to your needs.

Complete your Canada FIN-400 online today to ensure compliance and avoid penalties.

Get form

To qualify for a $10,000 tax refund in Canada, ensure you file your tax return accurately and claim all eligible deductions and credits. Assess your financial situation, including any overpayments made during the year, as this applies to the Canada FIN-400 guidelines. Utilizing the US Legal Forms platform can help you complete your tax documents correctly, maximizing your chances of receiving a substantial refund.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.