Loading

Get India Phs/42

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the India PHS/42 online

Filling out the India PHS/42 form is a crucial step in managing life insurance documentation. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the India PHS/42 form

- Click the ‘Get Form’ button to obtain the form. This will allow you to access and open the document for your needs.

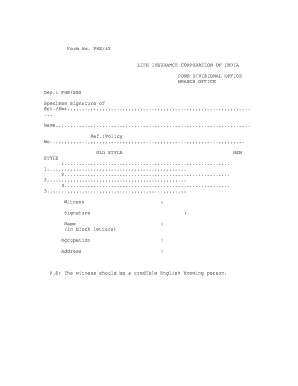

- In the first section, enter the full name of the individual as per the policy details, placing it in the designated field for 'Name'.

- Next, look for the policy number field and accurately fill in the reference policy number to ensure correct association with the existing insurance policy.

- Complete the signature field by entering your specimen signature clearly; this serves as a formal verification of your information.

- In the witness section, select a credible individual who understands English. They will need to fill out their name, occupation, and address in the respective fields provided.

- Review all entries for accuracy and completeness to avoid delays or issues in processing the form.

- Once you have verified the information, you can save the changes made to the form, download it for your records, print it, or share it as needed.

Complete your document online to ensure a smooth filing process.

Related links form

To apply for a tax residency certificate in India, you need to gather the necessary documentation, such as your passport and proof of residence. The process usually requires submitting Form 10F along with your application. By completing this process effectively, you will align with India's PHS/42 regulations. If you require assistance, consider using uslegalforms for a guided experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.