Loading

Get Nz Ir344 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NZ IR344 online

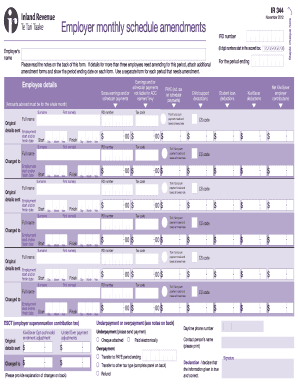

The NZ IR344 form is essential for employers to report amendments to employee details submitted in previous Employer monthly schedules. Understanding how to fill it out accurately ensures compliance and corrects any payroll discrepancies.

Follow the steps to complete the NZ IR344 online easily.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the employer's name in the appropriate field, ensuring the correct spelling and format.

- Input the 8-digit employer's IRD number in the designated box, starting in the second box.

- Read the notes on the back of this form to understand the requirements, especially regarding amendments for more than three employees.

- For each employee requiring amendment, fill out their full name, surname, IRD number, PAYE tax code, and employment start and finish dates.

- Indicate if a lump sum payment was made and taxed at the lowest rate by ticking the appropriate box.

- Provide gross earnings and/or schedular payments for the month for each employee.

- If necessary, include adjustments for KiwiSaver contributions, student loan deductions, or child support deductions by entering the relevant amounts in their respective fields.

- Review the calculations for any underpayments or overpayments in deductions, and specify how to handle the overpayment.

- Add any supporting explanations for changes made in the designated area, ensuring transparency and clarity.

- After completing the form, save your changes, and prepare to download, print, or share the document as needed.

Complete your NZ IR344 amendments online today for accurate payroll management.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing for child support in NZ involves completing the necessary forms and providing accurate financial details. You can submit your application through the Child Support Agency. The NZ IR344 might play a role in understanding your income and obligations regarding child support. Consider utilizing the US Legal platform for easy access to the required documents.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.