Loading

Get Uk Hmrc Hs295 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC HS295 online

This guide provides a clear and supportive approach to completing the UK HMRC HS295 form online. Whether you are new to tax forms or seeking clarification, this guide will assist you through each section with detailed step-by-step instructions.

Follow the steps to successfully complete your HS295 form.

- Click ‘Get Form’ button to access the form and open it in the editor.

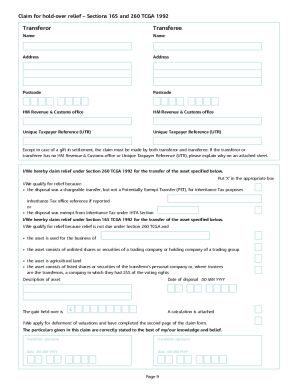

- Begin by entering the names and addresses of both the transferor and transferee in the designated fields. Ensure that all details are accurate to avoid processing delays.

- Fill in the Unique Taxpayer Reference (UTR) for both parties. If one of the parties does not have a UTR, provide an explanation on an attached sheet.

- Indicate whether you are claiming hold-over relief for the transfer of an asset by ticking the appropriate box. Specify the nature of the relief you are applying for.

- Complete the section detailing the asset’s description and the amount of the gain that is to be held over. This is crucial for your tax calculations.

- Provide the date of disposal in the required format. Ensure this date is correct as it may affect your tax obligations.

- If applicable, request the deferment of valuations by completing the second part of the form. This is necessary for transactions involving complex valuations.

- Review all entries for accuracy before signing. Both transferor and transferee must provide their signatures and dates where indicated.

- After reviewing your form, save your changes. You may choose to download, print, or share the completed form according to your needs.

Ensure your tax filings are accurate; fill out your forms online today.

Yes, you typically need to complete capital gains if you have sold an asset and made a profit. This applies to various assets, like properties and stocks. Understanding how to report capital gains is essential for adherence to the UK HMRC HS295 requirements, which outline the necessary steps for calculating and documenting your gains.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.