Loading

Get Uk Hmrc Iht401 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC IHT401 online

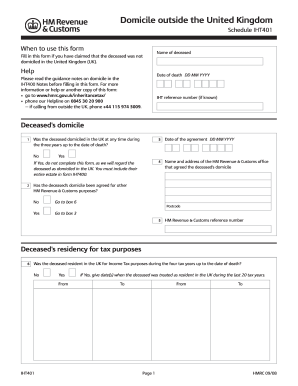

The UK HMRC IHT401 form is essential for individuals claiming that a deceased person was not domiciled in the United Kingdom. This guide will provide clear, step-by-step instructions to help users successfully complete the online form.

Follow the steps to fill out the UK HMRC IHT401 online.

- Press the 'Get Form' button to obtain the IHT401 form and open it in the editor.

- In the first section, provide the name and date of death of the deceased. This includes entering the deceased's domicile and any IHT reference number if known.

- Answer the questions regarding the deceased's domicile status, including whether they were domiciled in the UK at any time during the last three years before death.

- Indicate whether their domicile has been agreed upon for any other HM Revenue & Customs purposes. If yes, follow the instructions provided.

- Provide details about the deceased's residency for tax purposes in the UK during the four tax years leading up to their date of death.

- Fill out the deceased's history, including their place of birth, nationality at birth and at death, and any relevant information about their time spent living abroad.

- Answer questions about marital status concerning the deceased's husband's domicile, particularly if they were married before January 1, 1974.

- Discuss the deceased's estate, detailing beneficiaries and any deductions that apply.

- Conclude by reviewing the information provided, ensuring accuracy before saving changes, and proceed to download, print, or share the completed form.

Complete your UK HMRC IHT401 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To notify HMRC that you have left the UK, you should fill out the appropriate forms and inform them about your change of residency. Additionally, when completing your tax return, reference the IHT401 for any inheritance tax matters. Ensuring HMRC has your updated information helps maintain clarity in your financial responsibilities while abroad.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.