Get Mo 580-2023 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO 580-2023 online

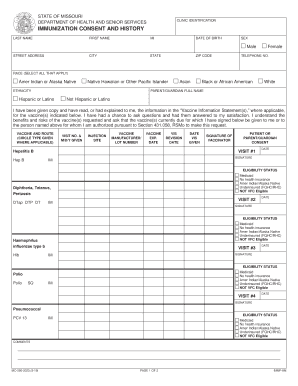

The MO 580-2023 is an essential document used for immunization consent and history in the state of Missouri. This guide will provide you with a step-by-step approach to easily complete the form online, ensuring that you provide all necessary information accurately and efficiently.

Follow the steps to fill out the MO 580-2023 online effectively.

- Press the ‘Get Form’ button to access the MO 580-2023 form and open it in your browser or chosen application.

- Begin filling out the 'Clinic Identification' section. Here, enter the relevant clinic details such as name and identification number, ensuring accuracy.

- In the 'Patient Information' section, input the last name, first name, middle initial, date of birth, sex, street address, city, state, and ZIP code of the patient.

- Next, enter the telephone number and select the appropriate race categories, marking all that apply.

- Indicate the patient's ethnicity by selecting either 'Hispanic or Latino' or 'Not Hispanic or Latino'.

- Fill out the 'Parent/Guardian Full Name' section if the patient is underage, providing the full name of the responsible adult.

- Review the vaccination information section where you will confirm that you have read the Vaccine Information Statements. Check the box to indicate your understanding.

- For each vaccine administered, provide details such as the type of vaccine, the date given, injection site, manufacturer and lot number, expiration date, and the signature of the vaccinator.

- Repeat step 8 for each subsequent visit until all relevant vaccinations have been documented.

- Complete the 'Eligibility Status' section by selecting applicable options regarding health insurance or eligibility.

- Lastly, review the entire form for completeness, accuracy, and ensure all required signatures are present before saving your changes.

Complete your MO 580-2023 form online to ensure a smooth immunization process.

The MO 1040 is the standard form for individual income tax filing in Missouri, while the MO 1040A is a simplified version available for taxpayers with fewer sources of income and straightforward tax situations. Depending on your financial situation, you may find one form easier to use. When completing the necessary forms for state taxes, be sure to consider the completeness of each form in relation to your filings like the MO 580-2023.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.