Loading

Get Ca De 927b 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA DE 927B online

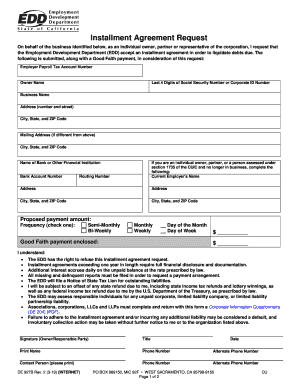

This guide provides a comprehensive overview of how to fill out the CA DE 927B form online. By following the steps outlined below, you will successfully submit your installment agreement request to the Employment Development Department (EDD).

Follow the steps to complete the CA DE 927B form online:

- Press the ‘Get Form’ button to obtain the CA DE 927B form and open it in your document editor.

- Begin by entering the Employer Payroll Tax Account Number, which identifies your business’s tax account.

- Provide the owner name, ensuring that the format is clear and includes the full legal name of the responsible individual.

- Enter the last four digits of the Social Security Number or Corporate ID Number associated with the business.

- Fill in the business name as registered with the EDD, followed by the full address including number, street, city, state, and ZIP code.

- If applicable, enter the mailing address if it differs from the business address. Include the city, state, and ZIP code.

- Input the name of the bank or financial institution, along with the bank account number.

- For individual owners, partners, or responsible persons assessed under section 1735 who are no longer in business, enter the current employer's name and their routing number.

- Fill in additional address details for your current employer, ensuring all sections are complete.

- State your proposed payment amount and select the frequency of payments. Options include semi-monthly, bi-weekly, monthly, or weekly.

- Include the Good Faith payment amount, ensuring accuracy, and attach it in your submission.

- Acknowledge understanding of the terms indicated on the form regarding installment agreements, including potential refusals and the implications of default.

- Provide your signature, title, printed name, phone number, alternate phone number, and details of a contact person, if necessary.

- Review the entire form for completeness and accuracy before saving your changes, downloading, or printing the document.

Complete your documents online to ensure prompt processing.

California's EDD benefits can vary widely based on individual circumstances, but typical payments are between $40 and $450 per week for unemployed workers. For those qualifying under recent federal programs, additional funds might apply, increasing this total significantly. To explore your possible earnings, the CA DE 927B feature offers comprehensive guidance and resources tailored to your situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.